Table of Content

This means that, every year, your rates may rise or fall. Mortgage rates have fluctuated in line with national mortgage rates over the past two years. Purchasing mortgage discount points can be a viable option if you are fairly certain you will live in the house for many years. However, if you move after a couple years then paying a significant upfront fee to lock in lower rates for the life of the loan will be money wasted. Fixed rate loans are by far the safest loans for consumers over a period of time.

Mortgage rates have steadily ticked up since the beginning of March, reaching a 12-year high of 5.11% in mid-April. To get the best mortgage loan, know how much you can afford and shop like the bargain hunter you are. Under "Loan term," click the plus and minus signs to adjust the length of the mortgage in years. The cash you pay upfront when buying a home as a percentage of your full loan amount. By starting it online or by meeting with a mortgage loan officer. Known for its breathtaking and awe-inspiring natural landmarks, Washington has a lot to offer those who call it home.

Mortgage options in Washington

If the down payment is less than 20%, mortgage insurance may be required, which could increase the monthly payment and the APR. Non-conforming rates are for loan amounts exceeding $647,200 ($970,000 in AK and HI). Use our free mortgage calculator tools to estimate your monthly mortgage payments based on your unique loan scenario. See how your monthly payment changes by making updates to your home price, down payment, interest rate, and loan term. Hybrid Adjustable Rate Mortgages offer the consumer a low interest rate for a certain period of time. Then, they increase or adjust to the current rate after fixed rate period has elapsed.

In some cases, the fees can be high enough to cancel out the savings of a low rate. Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you don’t have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time won’t show up on your credit report as it’s usually counted as one query. Your policy covers damage and financial losses from fire, storms, theft, a tree falling on your house and other bad things. As with property taxes, you pay roughly one-twelfth of your annual premium each month, and the servicer pays the bill when it's due. Determining what your monthly house payment will be is an important part of figuring out how much house you can afford.

Accelin Loans

The coronavirus pandemic hit Washington state hard early on, rattling real estate markets. Low interest rates and the possibility of finding a bargain should attract homebuyers to the Evergreen state in 2020. Most sellers won’t entertain any offers without a pre-approval letter. You can get a pre-approval letter by passing a lender’s credit checks and initiating the mortgage process.

Thirty-year mortgages carry a higher interest rate than 15-year loans, as the lender is guaranteeing a fixed rate for twice as long. Switching from a 30-year mortgage to its 15-year cousin will increase monthly payments, but can cut the amount of interest owed by tens of thousands of dollars over the lifetime of the loan. FHA Loans offer low down payments, low closing costs, and are easier to qualify in regards to income or credit score. Use ERATE®'s rate chart to compare today's top rates in Washington and find a lender that's the best fit for you.

How lenders decide how much you can afford to borrow

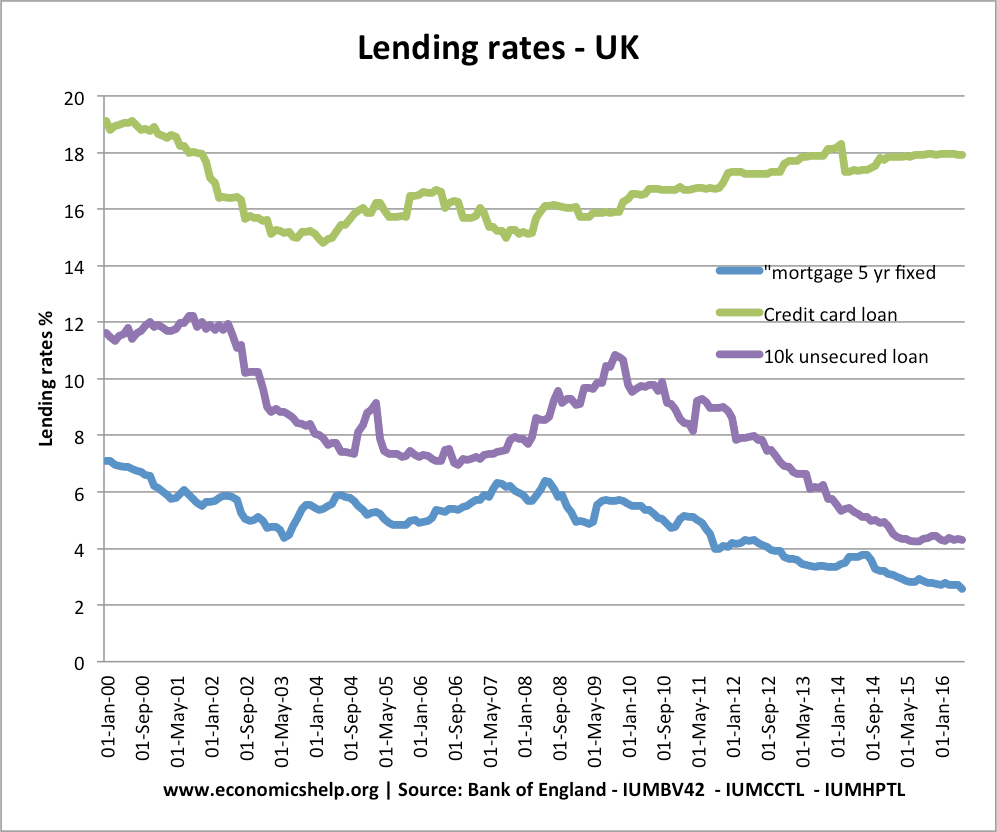

Mortgage rates vary depending upon the down payment of the consumer, their credit score, and the type of loan that will be acquired by the consumer. For instance, in February, 2010, the national average mortgage rate for a 30 year fixed rate loan was at 4.750 percent (5.016 APR). The 15 year fixed was at 4.125 percent (4.312 APR) and the 5/1 ARM was at 3.875 percent (3.122 APR).

Some of the Services involve advice from third parties and third party content. You agree that Interest.com is not liable for any advice provided by third parties. To use some of the Services, you may need to provide information such as credit card numbers, bank account numbers, and other sensitive financial information, to third parties. By using the Services, you agree that Interest.com may collect, store, and transfer such information on your behalf, and at your sole request. You agree that your decision to make available any sensitive or confidential information is your sole responsibility and at your sole risk. Interest.com has no control and makes no representations as to the use or disclosure of information provided to third parties.

Conforming Mortgage Limits

According to the Census Bureau, the median household income in Lincoln County is slightly less than $47,000. The median value of owner-occupied homes in the area is roughly $143,000. With jobs in nearby Spokane, Lincoln County offers affordable real estate. The Washington Center for Real Estate Research has calculated the median home price in the Evergreen State to be roughly $338,000. This represents a 6.6% annual increase from the organization's previous survey. The property analyst also estimates that the number of home sales has been increasing at a very impressive 11.6%.

Estimated monthly payment and APR assumes that the upfront mortgage insurance premium of $4,644 is financed into the loan amount. The estimated monthly payment shown here does not include the FHA-required monthly mortgage insurance premium, taxes and insurance premiums, and the actual payment obligation will be greater. Many home loan options are available in the Evergreen State.

The average home across the state sells for $406,602 and has an annual propert tax assessment of $3,592. In Settle annual property taxes cost $4,767 whereas the national average is $3,313. Due to high property prices across the states & high local living costs refinancing is widely used along with home equity lines of credit .

Since this introductory period usually has low rates, adjustable-rate mortgages are a good option for short-term savings. The predictability and stability of fixed-rate loans make them very popular with new homebuyers and long-term financial planners. As a caveat, fixed-rate mortgages tend to have higher rates compared to other loans. It’s expensive to buy a home in Washington, D.C. Not only are home values excruciatingly high, but mortgage rates and costs of living are both more than the national average.

For example, if your total monthly income is $7,000, then your housing payment shouldn’t be more than $2,170 to $2,520. However, it also depends on how much of your income is already spoken for through debt payments as well as your credit score and history. The more debt you have, the less likely you will be approved for a mortgage or one at a lower interest rate.

No comments:

Post a Comment